In a world captivated by the promise of digital currencies and disruptive technologies, Bitcoin emerged as a symbol of financial rebellion—a decentralized dream that promised freedom from traditional banking systems. Yet, more than a decade later, its volatile nature and speculative value have left investors questioning whether it’s truly the future of money or merely a digital illusion fueled by hype.

Meanwhile, a new wave of digital assets is rising—one that seeks to bridge the gap between the virtual and the tangible. Hydrokken, founded by visionary entrepreneur El Mostafa Belkhayate, offers a refreshing alternative. Unlike cryptocurrencies driven by market speculation, Hydrokken is backed by real-world equity in Hydroma Inc., a company developing natural hydrogen as a sustainable energy solution. This asset-backed model represents a paradigm shift in digital finance—where value is tied not to speculation, but to measurable economic activity and long-term sustainability.

In this insightful interview, El Mostafa Belkhayate shares his perspective on the pitfalls of speculative cryptocurrencies, the untapped potential of hydrogen energy, and why he believes the future of finance lies in combining digital accessibility with real-world impact. As we explore the contrast between Bitcoin’s speculative allure and Hydrokken’s tangible promise, you’ll discover a bold vision for ethical investing in a fast-changing world.

Prepare to delve into a thought-provoking discussion where illusion meets reality, and speculation gives way to substance.

Spark Behind the Journey

We started the interview by asking, “What inspired you to create Hydrokken, and how does it differ from Bitcoin?”

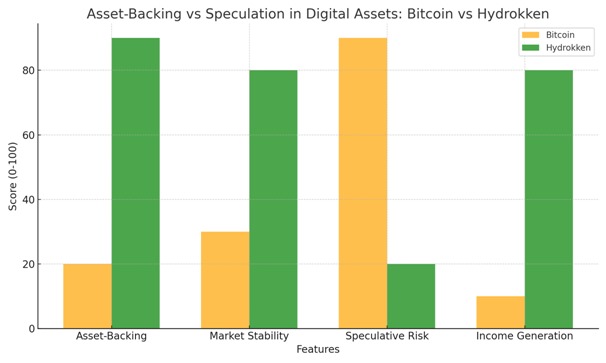

Mostafa shared, “Hydrokken was inspired by a vision to merge two critical goals: democratizing access to high-value investments and addressing the global need for clean, renewable energy. While Bitcoin is often hailed as a digital revolution for its decentralized nature and scarcity model, it remains highly speculative, with no backing from tangible assets. In contrast, Hydrokken is backed by equity in Hydroma Inc., a company with proven hydrogen reserves and a track record of successful projects. This ensures that Hydrokken’s value is tied to real-world assets, offering both stability and long-term growth potential.”

The Future of Digital Finance

We were interested to learn more about Mostafa’s perspective on Hydrokken being the next big thing. We asked, “Why do you believe asset-backed tokens like Hydrokken are the future of digital finance?”

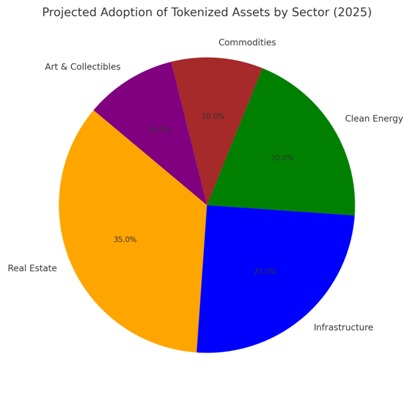

He shared, “The future of finance lies in combining digital accessibility with tangible, real-world value. Asset-backed tokens, such as Hydrokken, represent a new frontier where investors can directly own fractions of valuable enterprises without the traditional barriers of high capital requirements.

With blockchain technology ensuring transparency, liquidity, and seamless transactions, asset-backed tokens provide a secure and inclusive investment model. Hydrokken is a prime example of this shift—linking digital finance to a growing clean energy sector, where returns are based not on hype but on real operational success.”

Hydrokken – Advantage Over Conventional Cryptos

We further asked, “What are the key advantages of investing in Hydrokken over traditional cryptocurrencies?”

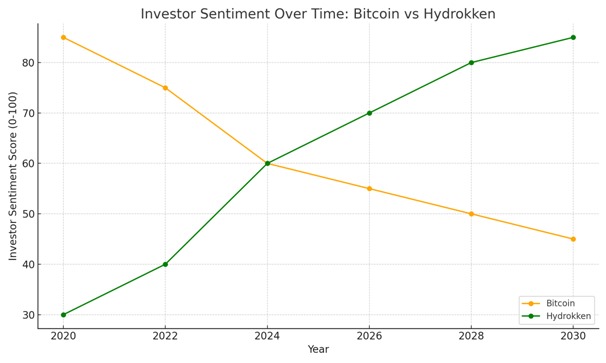

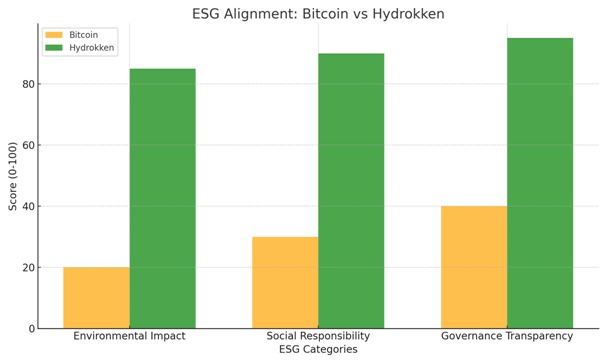

He added, “Investing in Hydrokken offers several critical advantages. Firstly, Hydrokken is inherently less volatile because it is directly linked to income-generating assets. Traditional cryptocurrencies like Bitcoin derive their value from market speculation, making them prone to sharp price swings.

Secondly, Hydrokken aligns with ESG (Environmental, Social, and Governance) principles by supporting clean energy projects. Thirdly, through fractional ownership, investors can access the high-growth hydrogen economy without the need for significant upfront capital, something not possible with speculative assets like Bitcoin.”

The Quantum Threat: Can Bitcoin Code Be Hacked?

Curious about the technical risks facing Bitcoin, we inquired, “What are your thoughts on the potential threat posed by quantum computing to Bitcoin’s security?”

Mostafa explained, “Bitcoin’s blockchain relies heavily on cryptographic algorithms for transaction security. However, the development of quantum computers could eventually pose a significant threat by potentially breaking these cryptographic defenses. This is a risk that asset-backed tokens like Hydrokken don’t face in the same way, as our value doesn’t rest solely on cryptographic trust but on real-world assets and income.”

Why Bitcoin Remains a Speculative Gamble

To draw a contrast with Hydrokken, we asked, “Why do you believe Bitcoin remains a speculative gamble?”

Mostafa elaborated, “Bitcoin is driven primarily by market sentiment and speculative behavior. It doesn’t produce revenue or represent ownership of any real-world assets. Its extreme volatility reflects this speculative nature. In contrast, Hydrokken’s value is tied directly to tangible infrastructure and real economic activity, making it far less susceptible to speculation.”

A Decades-Long Trade? The Theory of Long-Term Manipulation

Addressing the controversy surrounding Bitcoin’s market dynamics, we asked, “Some analysts suggest Bitcoin may be subject to long-term manipulation. What’s your take on this theory?”

He commented, “It’s true that Bitcoin’s relatively low circulating supply and concentration of ownership among a few large holders, often called ‘whales,’ make it susceptible to manipulation. While there’s no hard evidence, recurring patterns of extreme price cycles raise valid concerns. With Hydrokken, our goal is to offer a transparent and stable investment alternative backed by real income sources, reducing the risk of such manipulative behavior.”

Is a Powerful Organization Behind Bitcoin? Possible Motives

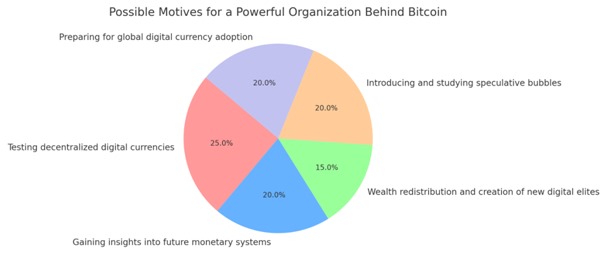

Finally, we posed a provocative question: “There are theories that a powerful organization might be behind Bitcoin. Do you think there’s any truth to this, and what could their motives be?”

Mostafa replied thoughtfully, “The anonymity of Bitcoin’s creator, Satoshi Nakamoto, has indeed sparked numerous theories. While it is widely accepted that Satoshi was a brilliant individual or small group of cryptographers, the complete absence of identity and communication after the early years raises questions. Some suggest that a government, intelligence agency, or major financial institution could have been involved in its creation, either to test the viability of decentralized digital currencies or to study their potential impacts on global financial systems.”

He continued, “One theory posits that Bitcoin may have been a strategic experiment in monetary policy. By observing how the world reacts to a decentralized, non-sovereign currency, powerful entities could gain valuable insight into future monetary systems. This could explain why Satoshi chose to remain anonymous—if the creator were tied to a known institution or country, it might have influenced public trust and market behavior.”

“Another possible motive,” Mostafa added, “is to introduce a new mechanism for wealth redistribution. Bitcoin’s early adopters, who took significant risks when it was virtually worthless, became incredibly wealthy as its value skyrocketed. This has created a new class of digital millionaires and billionaires, redistributing wealth from traditional systems into this new ecosystem. If a powerful organization were behind Bitcoin, orchestrating speculative bubbles and price manipulation over time could serve to concentrate wealth in fewer hands.”

He also pointed out the possibility of “preparing the groundwork for a globally controlled digital economy. Governments and financial institutions have been increasingly interested in central bank digital currencies (CBDCs). It’s conceivable that Bitcoin could have served as a precursor or a model to test public acceptance of digital money before introducing government-controlled digital currencies.”

Mostafa concluded, “While these theories remain speculative, what we do know is that Bitcoin’s opaqueness leaves room for mistrust. At Hydrokken, we’ve taken a different approach by focusing on transparency, real-world value, and tangible assets. Unlike Bitcoin, where the mystery of its origins continues to spark debate, Hydrokken is built on a foundation of verifiable infrastructure, clear ownership, and measurable outcomes. This is why I believe that in the long term, asset-backed tokens like Hydrokken will be seen as a safer, more reliable form of digital investment.”

Follow El Mostafa Belkhayate on LinkedIn or Whatsapp .

Also Read :-

Redefining Businesses With AI And Smart Solutions With Simple Complex Solutions: Robert Braxton

Baillie Gifford US Growth Trust Defends Against Saba’s Board Shake-Up Bid